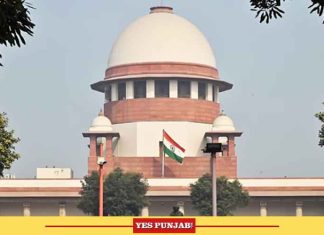

New Delhi, Nov 24, 2024

The Supreme Court has ruled that a sale certificate issued in pursuance to a court’s auction is not required to be stamped.

A bench, headed by Justice J.B. Pardiwala, was dealing with the question if it is mandatory for the successful auction purchaser to deposit the stamp duty for the sale certificate to be issued to it in view of the provisions of the Stamp Act and the Registration Act.

In its judgment, the Punjab and Haryana High Court allowed the writ petition and directed the respondent to hand over the original sale certificate to the writ petitioner and send a copy of the same to the Sub-Registrar under Section 89(4) of the Indian Registration Act, 1908.

It also held that the writ petitioner was entitled to a refund of the stamp duty deposited.

Punjab United Forge Ltd was ordered to be wound up and permission was granted to the Industrial Finance Corporation of India (IFCI) to sell the properties mortgaged with it and also the properties hypothecated with the Andhra Bank.

The IFCI invited tenders for the immovable and movable assets to be put to an auction wherein Ferrous Alloy Forging Pvt Limited, a sister concern of the writ petitioner, offered the highest bid and as a result, the auction sale was confirmed in its favour.

Thereafter, the writ petitioner moved an application requesting for execution of the conveyance deed in its favour on the ground that the entire sale consideration was paid by it. The request was declined by the company law judge of the high court but an appeal was allowed by a division bench.

The writ petitioner also filed an application for the issuance of a sale certificate in its capacity as the successful auction purchaser for both the movable and immovable properties.

The company judge of the P&H High Court disposed of the application taking the view that the writ petitioner was liable to pay the stamp duty on the immovable properties which had been put to auction which would include land, buildings, and permanently affixed machinery.

It further directed that although the immovable properties which were put to auction were to be included in the certificate of transfer, their value would be excluded for the purpose of computation of stamp duty.

The Registrar took the view that stamp duty had to be paid on Rs. 2.25 crore which was the valuation of the immovable properties as offered in the tender and the writ petitioner was directed to pay stamp duty on Rs.2.25 crore for the sale certificate to be issued in its favour.

The directions issued by the Registrar were challenged by way of a writ petition for being in derogation of Section 17 (2)(xii) of the Registration Act, read with Rule XXI Order 94 of CPC.

The High Court allowed the writ petition taking the view that there was no occasion for fixation of stamp duty at the time of issuance of the sale certificate and the Registrar was only required to issue the sale certificate and send a copy of the same to the Sub-Registrar in accordance with the mandate contained in section 89(4) of the Registration Act. It further directed that the stamp duty deposited by the writ petitioner be refunded within a period of one month.

Aggrieved with the decision, the Punjab government moved an appeal before the Supreme Court.

The top court, referring to its decision in the Municipal Corporation of Delhi v. Pramod Kumar Gupta case, observed that the transfer becomes final when an order under Rule 92 of Order XXI is made and the issuance of a sale certificate under Rule 94 is only a formal declaration of the effect of such confirmation.

“Such issuance of the certificate does not create or extinguish any title and thus would not attract any stamp duty which is applicable qua an instrument of sale of immovable property,” it added.

The Supreme Court said that a sale certificate issued to the purchaser in pursuance of the confirmation of an auction sale is merely evidence of such title and does not require registration under Section 17(1) of the Registration Act.

“It is not the issuance of the sale certificate which transfers the title in favour of the auction purchaser. The title is transferred upon successful completion of the sale and its confirmation by the competent authority after all the objections against the sale have been disposed of.”

Dismissing the Punjab government’s appeal, it said that the sale certificate issued by the authorised officer is not compulsorily registrable and mere filing under Section 89(4) of the Registration Act itself is sufficient when a copy of the sale certificate is forwarded by the authorised officer to the registering authority.(Agency)