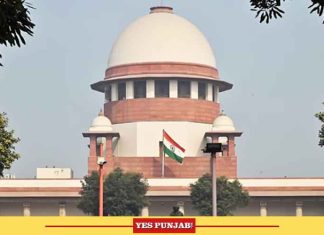

New Delhi, Nov 10 2024-

The Delhi High Court has directed the Employees’ State Insurance Corporation (ESIC) to extend all benefits under the Covid scheme to the wife of a deceased whose claim was rejected on the ground that the workman was drawing salary above the prescribed limits.

The ESIC had rejected the claim on the ground that the deceased did not fall within the meaning of the expression “employee” under Section 2(9) of the Employees’ State Insurance Act and he was also being paid a sum of Rs 2,674 per month towards incentive, thereby making his monthly salary more than Rs 21,000 per month.

In the pleadings filed before the Delhi High Court, the ESIC admitted that the petitioner’s husband died in July 2020 due to Covid but the workman was drawing salary beyond the wage limit prescribed under Section 2(9) of the ESI Act as reflected in his salary slip, so the benefit of the Covid Scheme could not be granted to his dependent.

The petitioner-wife claimed that for the purposes of benefit under the Covid Scheme, the monthly wages of the workman of Rs 19,585 should be considered and not the other amount of Rs. 2,674.

In its judgment, the Delhi High Court noted that the Covid Scheme was a welfare measure for the persons insured under the ESI Act and provided relief to the dependents of the insured persons in case of their death due to Covid-19 by way of periodic payments directly into their bank accounts.

“The eligibility conditions for grant of benefit under the Covid Scheme were that the insured person who died due to Covid disease must have been registered on the ESIC online portal at least three months prior to the date of diagnosis of Covid disease resulting in his/her death, and the deceased insured person must have been in employment on the date of diagnosis of Covid disease and the contributions for at least 70 days should have been paid or payable in respect of him/her during a period of maximum one year preceding the diagnosis of Covid disease resulting in death,” it noted.

After going through the wage certificate issued by the employer, the Delhi HC said that the workman was drawing a salary of Rs 19,585 per month and he was also being given a “special incentive of Rs 2,674 for four months i.e. March, April, May, and June 2020”. It added that the purpose of paying such special incentives during those harrowing days of the Covid pandemic was to enable the working class to bear additional expenditure in the form of masks, gloves, sanitisers and other necessary articles including those related to travel to work, so that the work could go on, ensuring minimum damage to economy of the country and that special incentive also was only a temporary one, aimed at dealing with the working in the Covid environment.

“Keeping in mind the benevolent nature of the Covid Scheme, coupled with the nomenclature of the monthly payment of Rs. 2,674, I find it not acceptable to add the said amount to the monthly wages so as to throw the petitioner out of the social welfare ambit of the scheme,” said a single-judge bench of Justice Girish Kathpalia.

The bench said that Rs 2,674 was a special incentive granted to the workman during the Covid pandemic, that too for only four months preceding his death and even during those four months, the employer/ESIC continued to deduct ESI contribution from his salary.

Allowing the writ petition, the Delhi High Court quashed the impugned action, denying the benefit of the Covid Scheme.

“The respondents are directed to grant all benefits under the Covid Scheme to the petitioner within four weeks,” it ordered. (Agency)