New Delhi, Nov 3, 2024

A home loan applicant’s widow’s mother has got relief from the National Consumer Commission that has directed his life insurer to pay over Rs 14 lakh cover, setting aside the company’s claim that the Chhattisgarh resident died due to ailments not covered under the policy.

After Ashok Patel’s death, his mother Rupkuwar Patel dragged HDFC Ergo General Insurance to consumer court in 2018 after it failed to pay the insurance claim to settle the home loan. The district forum and the State Consumer Commission held the company guilty of deficiency in service and directed it to pay up.

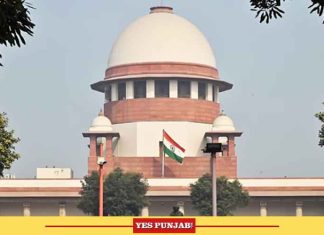

The Apex Consumer Court has now upheld the findings of the two lower courts which held that the denial of a death insurance claim to Patel’s mother was a deficiency in service.

Inderjit Singh, presiding member, NCDRC, said in the verdict: “After giving thoughtful consideration to the entire facts and circumstances of the case, various pleas raised by the parties, we find that there is no illegality or material irregularity or jurisdictional error in the order of the State Commission, hence the same is upheld. Accordingly, the Revision Petition by (HDFC Ergo General Insurance) is dismissed.”

After the NCDRC’s recent verdict, the insurance company has the option of challenging the decision in the Supreme Court.

Two months after Patel died in September 2017, his mother was informed that her son’s insurance claim had been repudiated on the ground that his death was due to Acute Respiratory Distress Syndrome (ARDS), Acute Respiratory Failure, and Sickle Cell Crisis. The said ailments were not covered under the insurance policy.

The insurance company said in its appeal before the National Consumer Commission that: “The State Commission failed to appreciate the settled law that the onus is on the insured to prove that the claim falls under the purview of the policy.

As per the Claim Forum, Ashok Patel’s mother had lodged a claim for ‘stroke’ but failed to establish that the insured had suffered or died due to stroke. Therefore, the impugned order is liable to be set aside on this sole ground itself.”

The NCDRC endorsed the State Commission’s decision, upholding that Rupkuwar Patel was the nominee of the deceased, hence, she had the right to file a claim.

The State Commission said the insurance company did not produce any documents from which it could be ascertained that Ashok Kumar Patel had given any wrong information in the proposal form of the policy.

“Therefore, the arguments of the company are not acceptable in the absence of any documentary evidence to support them.

They cannot be accepted on the basis of mere pleadings, hence, the concerned forum has not committed any error by accepting the complaint. Therefore, the appeal should be dismissed and the order passed should be confirmed,” the State Commission said, concurring with the district forum’s findings.(Agency)