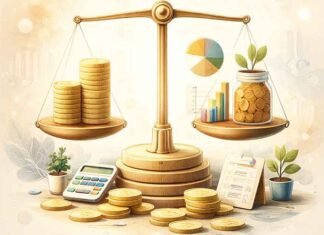

When investing in the stock market, one must understand brokerage charges in order to maximize profit. Every trade incurs a cost called brokerage, which varies depending upon its broker, trading volume, and type of investment. This ultimate guide aims to provide insight on brokerage charges and brokerage calculations and ways to minimize these costs for better returns.

What Are Brokerage Charges?

Brokerage charges are the fees collected by stockbrokers for facilitating the transactions of buying and selling of stocks, commodities, or derivatives. The charges are determined based on whether the trade is categorized as intraday, delivery, futures, or options and whether it follows the pricing model of the brokerage firm.

Types of Brokerage Charges

Fixed Brokerage: A predetermined amount charged for executing a transaction with no regard for the value of the trade.

Percentage-Based Brokerage: The broker charges a percentage of the total value of the trade.

Slab-Based Brokerage: This means different rates are applied for different bands of the transaction amount.

Zero Brokerage: Offered by a handful of discount brokers who allow commission-free trading along specific segments

Understanding these structures will help you figure out the most economical way to choose your broker according to your requirements.

How to Calculate Brokerage Charges?

Some other charges that also affect the total cost of a trade must be taken into consideration in addition to the brokerage fee. The main features include:

Brokerage Fee: Commission lived by the broker.

Securities Transaction Tax (STT): A tax levied on the purchase and sale of stocks.

Exchange Transaction Charges: Fees levied by the stock exchanges.

Goods and Services Tax (GST): Applicable on brokerage and transaction fees.

Stamp Duty: A state government charge on transactions.

SEBI Turnover Fees: Fees paid to the Securities and Exchange India Board.

The stock brokerage calculator puts everything in reference and is a way by which an investor may calculate total charges and net profits using it before going for any trade.

Brokerage Calculation Example

Assume you purchased shares worth Rs. 1,00,000, and your broker charges 0.1% for delivery trades. The brokerage fee will be:

Brokerage = (Trade Value × Brokerage Rate) / 100= (1,00,000 × 0.1) / 100= Rs. 100

Similarly, other charges such as STT and exchange fees, and GST will be calculated separately. All calculations will be made easy with a stock brokerage calculator that gives a clear understanding of your expense factors.

How to Save More on Brokerage Charges?

Underline the significance of less brokerage on greater return. A few more tips to save brokerage are:

1. Use a Discount Broker

Thus, if discount broker charges less than a full-fledged broker for trading fees as flat fees, it cut down brokerage massively.

2. Go with the Annual Membership Plan

Some brokers give an unlimited trading plan for a full annual fee. If you are a frequent trader, it would save you quite a lump sum.

3. Trade in Bigger Quantities

Some brokers refer slab based discounts where lower rates would apply to increase volume of trading. Planning bulk trades can save your brokerage.

4. Take the help of a Stock Brokerage Calculator

Make use of the stock brokerage calculator to get evaluation of charges and net profit before you are placing your trade.

5. Prefer Direct Mutual Funds

The Direct Plan invests funds in mutual. Avoid taking regular plans as there are distributor commissions that reduce the rate of return over time.

6. Avoid Very Frequent Trading

High brokerages and taxes incurred by excessive trade are avoidable through the planned long-term investment approach to minimize unnecessary expenses.

7. Use Margin Trading Carefully

With margin trading, you buy shares with funds borrowed from other sources. But it also has its interests and additional brokerage associated with it. So ensure the possible return is more than the extra cost.

Comparing Brokers: Finding the Best Deal

To a trader, Spread between brokers varies regarding their brokerage model. The brokerage model should thus be compared before choosing a broker.

- Brokerage Fees: That is flat-fee versus percentage-based.

- Hidden Charges: Most transaction or account maintenance fees of some other sort.

- User Experience: Less hassle use management and time effort processing go into the trade through an easily managed interface for all aspects of the trading account.

- Customer Support: A responsive person is always available for trade queries that the customers may have.

Final Word

Knowing how to calculate brokerage and cost-saving measures will increase the stock market profit. The stock brokerage calculator tells the amount to be incurred while trading and optimizes your investment strategy.

Right broker selection and avoiding unwanted trades along with technology can provide you with maximum returns with minimal brokerage costs. Take informed decisions, trade smartly, and watch your investments grow!