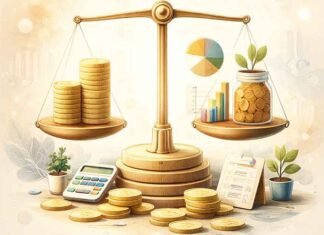

Term insurance is a fundamental component of financial planning, offering substantial life coverage at relatively low premiums. With the Indian insurance market constantly evolving, 2025 presents a variety of term insurance plans that cater to diverse financial needs.

These policies ensure financial security for policyholders’ families by providing significant coverage amounts at affordable rates. This article explores the top term insurance plans available in 2025, highlighting their features, benefits, and considerations for potential policyholders.

Understanding term insurance

Term insurance is a type of life insurance policy that provides coverage for a specified period or ‘term.’ If the insured individual passes away during this term, the nominee receives the sum assured. Unlike traditional life insurance policy, term plans do not offer maturity benefits, making them more affordable and straightforward.

Benefits of term insurance

Financial security – Provides monetary protection to your dependents, ensuring their financial well-being in case of unforeseen circumstances.

High coverage at low premiums – Offers substantial coverage amounts at minimal premium costs, making it an affordable option for individuals seeking comprehensive financial protection.

Tax benefits – Premiums paid towards term insurance are eligible for tax deductions under Section 80C of the Income Tax Act, 1961, and death benefits are tax-free under Section 10(10D).

Top term insurance plans in India for 2025

Here are some of the leading term insurance plans offering high coverage at low premiums in 2025:

LIC e-Term Insurance Plan

Overview: A non-participating pure life insurance policy available exclusively online, ensuring lower premiums by eliminating intermediaries.

Features:

Online purchase without intermediaries.

Differential premium rates for smokers and non-smokers.

Sum assured payable to nominees upon the policyholder’s death during the policy term.

30-day free-look period for policy cancellation.

Available to non-resident individuals, with coverage applicable even abroad, provided medical tests are conducted in India.

Benefits:

Death benefit – Sum assured is paid to the nominee upon the policyholder’s death during the policy term.

Tax benefit – Premiums paid up to ₹1,50,000 annually are deductible under Section 80C, and the death benefit is tax-exempt under Section 10(10D).

ICICI Pru iProtect Smart

Overview: A comprehensive term insurance plan offering extensive coverage options, including critical illness and disability benefits.

Features:

Coverage for terminal illnesses.

Option to add accidental death and critical illness riders.

Flexible premium payment options: single, regular, or limited pay.

Choice of death benefit payout: lump sum or income.

Benefits:

Comprehensive coverage – Includes life cover, critical illness, and disability benefits.

Flexibility – Multiple premium payment and benefit payout options to suit individual needs.

Tax benefits – Premiums paid are eligible for deductions under Section 80C, and payouts are tax-exempt under Section 10(10D).

HDFC Life Click 2 Protect Plus

Overview: A term insurance plan offering comprehensive protection with multiple plan options to cater to varying needs.

Features:

Four plan options: Life Option, Extra Life Option, Income Option, and Income Plus Option.

Option to increase cover on significant life events.

Special premium rates for non-tobacco users.

Flexible policy and premium payment terms.

Benefits:

Customizable coverage – Choose from various plan options and increase coverage as needed.

Affordability – Competitive premium rates, especially for non-tobacco users.

Tax benefits – Premiums qualify for deductions under Section 80C, and death benefits are tax-free under Section 10(10D).

SBI Life eShield

Overview: An online term insurance plan providing financial protection with optional rider benefits.

Features:

Two plan options: Level Cover and Increasing Cover.

Option to add accidental death benefit rider.

Special premium rates for non-smokers and female lives.

Rebates for large sum assured.

Benefits:

Flexible coverage – Choose between level and increasing cover options.

Additional protection – Option to enhance coverage with an accidental death benefit rider.

Tax benefits – Premiums are deductible under Section 80C, and death benefits are exempt under Section 10(10D).

Max Life Online Term Plan Plus

Overview: A term insurance plan offering comprehensive coverage with additional rider options for enhanced protection.

Features:

Three death benefit options: Lump Sum, Lump Sum plus Monthly Income, and Lump Sum plus Increasing Monthly Income.

Option to add accidental death and waiver of premium riders.

Flexible policy term and premium payment options.

Special premium rates for non-smokers and female policyholders.

Benefits:

Enhanced financial security – Offers various payout options to suit the financial needs of beneficiaries.

Additional coverage options – Policyholders can customize their plan with riders for extra protection.

Tax benefits – Premiums paid are deductible under Section 80C, and death benefits remain tax-free under Section 10(10D).

Conclusion

Term insurance remains an essential component of financial planning, offering high coverage at low premiums to ensure financial security for policyholders’ families. The various term plans available in 2025 cater to different financial needs, allowing individuals to select policies that best align with their budget and coverage requirements.

Whether opting for LIC’s e-Term, ICICI Pru iProtect Smart, or any other leading plan, choosing the right term insurance policy ensures peace of mind and financial stability for the future.

Before making a decision, individuals should carefully assess their financial goals, premium affordability, and coverage requirements. Consulting with a financial advisor can further help in selecting the most suitable term insurance plan for long-term security and peace of mind.