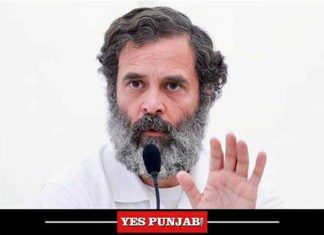

Mumbai, Dec 5, 2025

The Reserve Bank of India (RBI) on Friday raised its GDP growth forecast of the Indian economy to a robust 7.3 per cent for 2025-26 from 6.8 per cent earlier, on the back of an improved outlook driven by strong agricultural prospects, GST rate cuts continuing to play out, low inflation and strong balance sheets of corporates and banks.

Addressing a press conference after the monetary policy committee meeting here, RBI Governor Sanjay Malhotra said the surge in economic growth to 8.2 per cent in the second quarter of the current financial year and the sharp decline in inflation to 1.7 per cent had provided a rare “Goldilocks period” for the Indian economy.

“Looking ahead, domestic factors such as healthy agricultural prospects, continued impact of GST rationalisation, benign inflation, healthy balance sheets of corporates and financial institutions and congenial monetary and financial conditions should continue to support economic activity. Continuing reform initiatives would further facilitate growth,” Malhotra explained.

On the external front, he said, services exports are likely to remain strong, while merchandise exports face some headwinds. External uncertainties continue to pose downside risks to the outlook, while the speedy conclusion of various ongoing trade and investment negotiations presents upside potential.

“Taking all these factors into consideration, real GDP growth for 2025-26 is projected at 7.3 per cent, with Q3 at 7.0 per cent, and Q4 at 6.5 per cent. Real GDP growth for Q1:2026-27 is projected at 6.7 per cent and Q2 at 6.8 per cent. The risks are evenly balanced,” the RBI Governor stated.

Malhotra pointed out that the country’s real gross domestic product (GDP) registered a six-quarter high growth of 8.2 per cent in Q2:2025-26, underpinned by resilient domestic demand amidst global trade and policy uncertainties. On the supply side, real gross value added (GVA) expanded by 8.1 per cent, aided by buoyant industrial and services sectors. Economic activity during the first half of the financial year benefited from income tax and goods and services tax (GST) rationalisation, softer crude oil prices, front-loading of government capital expenditure, and facilitative monetary and financial conditions supported by benign inflation.

He further stated that high-frequency indicators suggest that domestic economic activity is holding up in Q3, although there are some emerging signs of weakness in a few leading indicators. GST rationalisation and festival-related spending supported domestic demand during October-November. Rural demand continues to be robust while urban demand is recovering steadily. Investment activity remains healthy with private investment gaining steam on the back of expansion in non-food bank credit and high capacity utilisation.

On the supply side, agricultural growth is supported by healthy kharif crop production, higher reservoir levels and better rabi crop sowing. Manufacturing activity continues to improve, while the services sector is maintaining a steady pace, he added.(Agency)