The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduced significant changes to the income tax structure, particularly concerning the section 87A rebate in the new tax regime.

These reforms aim to provide substantial relief to taxpayers and stimulate economic growth by increasing disposable income. The government’s focus is on making taxation more streamlined, reducing the burden on the middle class, and encouraging more individuals to opt for the new tax regime.

Key highlights of the budget

Increased tax exemption limit

The budget raised the non-taxable income threshold from Rs. 7 lakh to Rs. 12 lakh per annum under the new tax regime. This marks a significant increase in tax-free income, offering major relief to salaried and self-employed individuals. For salaried taxpayers, an additional standard deduction of Rs. 75,000 has been introduced, effectively making income up to Rs. 12.75 lakh tax-free.

This move aligns with the government’s efforts to increase taxpayers’ disposable income and reduce financial stress on the middle class. The enhancement of tax benefits will enable more people to invest, save, or spend their income on essential needs, thus boosting economic activity.

Revised income tax slabs

The revised income tax slabs under the new tax regime are as follows:

Up to Rs. 4 lakh: Nil

Rs. 4 lakh to Rs. 8 lakh: 5%

Rs. 8 lakh to Rs. 12 lakh: 10%

Rs. 12 lakh to Rs. 16 lakh: 15%

Rs. 16 lakh to Rs. 20 lakh: 20%

Rs. 20 lakh to Rs. 24 lakh: 25%

Above Rs. 24 lakh: 30%

These adjustments are designed to reduce the tax burden on the middle class while ensuring higher-income earners contribute proportionally. The restructuring of tax slabs ensures that individuals earning lower and moderate incomes can benefit from lower tax rates, thereby fostering economic stability and increasing savings.

Understanding the section 87A rebate

Section 87A rebate of the Income Tax Act provides a rebate that reduces the tax liability of individual taxpayers whose total income does not exceed a specified limit. In the 2025-26 budget, the government has increased the rebate under section 87A to Rs. 60,000, up from the previous Rs. 25,000. This enhancement ensures that individuals with an annual income of up to Rs. 12 lakh will have zero tax liability under the new tax regime.

For salaried taxpayers, the standard deduction of Rs. 75,000 further increases the tax-free income threshold to Rs. 12.75 lakh. This means that salaried individuals earning up to Rs. 12.75 lakh annually will not be liable to pay any income tax.

This expansion of section 87A benefits makes the new tax regime more attractive, especially for middle-income groups who are looking for simplified taxation without the need to claim multiple deductions.

How the section 87A rebate benefits different income groups

Individuals earning up to Rs. 12 lakh

They can claim the full rebate of Rs. 60,000 under section 87A.

Their effective tax liability is zero after applying the rebate.

Salaried individuals earning up to Rs. 12.75 lakh

They benefit from both the section 87A rebate and the standard deduction of Rs. 75,000.

This ensures their taxable income remains within the rebate limit, making them tax-free.

Individuals earning slightly above Rs. 12 lakh

They may face marginal relief, preventing them from paying disproportionately high taxes for earning slightly above the threshold.

Impact on taxpayers

Increased disposable income

With the enhanced section 87A rebate, individuals will have more money to allocate towards investments, savings, or discretionary spending. This could lead to improved financial well-being and economic growth, as higher disposable income boosts consumer spending and demand.

Simplified tax compliance

The new tax regime offers a more straightforward approach to taxation, with lower tax rates and minimal exemptions. By increasing the section 87A rebate, the government encourages more people to shift to the new system, making tax filing easier for individuals who do not wish to maintain complex records of deductions and exemptions.

Encouragement for higher earnings

Raising the tax-free income threshold to Rs. 12 lakh ensures that individuals can earn more without facing immediate tax deductions. This could encourage career growth, salary hikes, and entrepreneurship, as people will be motivated to increase their earnings without worrying about significant tax liabilities.

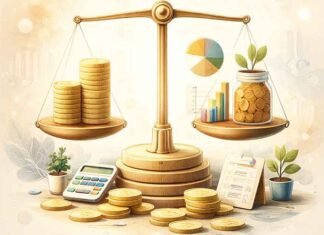

Comparison with the old tax regime

Although the new tax regime offers higher rebates and a simplified structure, taxpayers must compare their potential liabilities under both the old and new tax regimes.

The old tax regime allows individuals to claim various deductions under sections like section 80C for investments, section 80D for health insurance premiums, and section 24(b) for home loan interest. These deductions may still make the old tax regime more beneficial for some taxpayers, particularly those with higher deductions.

Section 80D and its role in tax planning

Section 80D provides deductions on health insurance premiums, making it a critical tax-saving tool for individuals and families. Under the new tax regime, these deductions are not available. However, for those opting for the old tax regime, the current limits are:

Rs. 25,000 per year for individuals below 60 years.

Rs. 50,000 per year for senior citizens.

An additional Rs. 50,000 for those paying for senior citizen parents.

Many experts have called for an increase in Section 80D deductions, citing rising healthcare costs. If these limits were raised, taxpayers in the old tax regime would see greater benefits.

Considerations for taxpayers

Taxpayers should assess their financial situations and consider the following before choosing between the old and new tax regimes:

Availability of deductions: If a taxpayer has high expenses in categories like home loan interest, health insurance, or other tax-saving investments, the old regime may still be beneficial.

Marginal relief: Those earning slightly above Rs. 12 lakh should check if marginal relief applies to prevent an excessive tax burden.

Long-term tax planning: Since the government is promoting the new tax regime with higher rebates, taxpayers should consider their long-term financial strategies while selecting the most suitable option.

Government’s objective with the revised tax structure

The government’s primary objective behind these changes is to simplify taxation and reduce compliance burdens. By enhancing the section 87A rebate and revising tax slabs, it seeks to make the new tax regime more attractive.

At the same time, measures like raising the tax exemption limit and providing relief through rebates align with the broader goal of increasing savings and investments in the economy.

Conclusion

The Union Budget 2025-26 introduces substantial changes to the income tax framework, particularly through the enhancement of the section 87A rebate and the revision of tax slabs in the new tax regime. These measures aim to reduce the tax burden on individuals, increase disposable income, and stimulate economic growth.

While the new tax regime offers simplified tax compliance and higher rebates, individuals should carefully evaluate their financial situation and tax-saving investments before making a decision. Taxpayers are encouraged to review these changes carefully and consider their options under both the new and old tax regimes to make informed financial decisions.