Mumbai, Dec 12, 2024

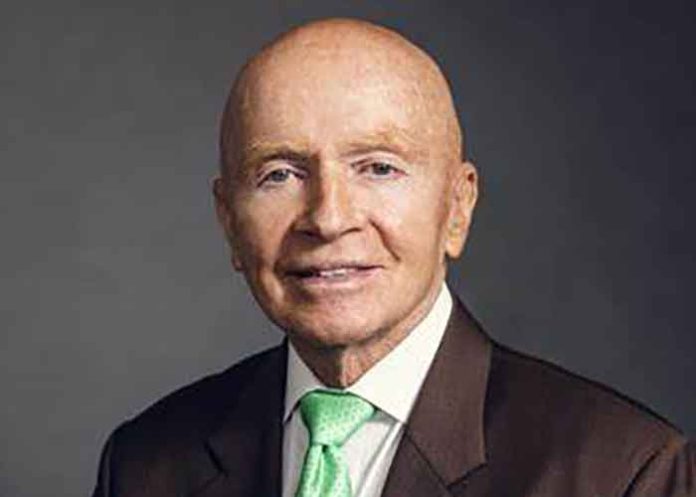

India’s ability to manage inflation without compromising growth will be pivotal in attracting sustained foreign investments, global ace investor Mark Mobius said on Thursday, adding that on a macro front, 6-7 per cent growth rate in India is a good rate given the global average.

Addressing an investor webinar organised by PL Capital-Prabhudas Lilladher, the veteran investor said the Indian economy grew a good 5.4 per cent in Q2 FY25, despite having a size as big as $4 trillion.

“On a macro front, 6-7 per cent growth rate in India is a good rate given the global average. ‘Make in India’ and the impetus the government provides to manufacture locally is a big positive and the biggest advantage of local manufacturing in India is that they have a big market for local/self-consumption,” said Mobius, Chairman of Mobius Emerging Opportunities Fund.

He further stated that the Indian government has done phenomenal work by creating solid infrastructure to support growth.

“Despite political challenges, PM Modi’s administration remains focused on reducing inefficiencies, modernising infrastructure, and enhancing governance. The central challenge lies in balancing populist measures with long-term structural reforms,” Mobius stated.

He highlighted key areas where India stands to gain both domestically and globally, identifying sectoral shifts and emerging opportunities, like defence manufacturing, semiconductors, infrastructure and urbanisation, tourism and travel growth, energy and commodities and digital public infrastructure.

On US President-elect Donald Trump’s trade tariffs, he said that Trump could use tariffs as a bargaining chip to negotiate open trade deals.

“Emerging Markets like India stand to benefit as there is a limit to which investors would want to put their money in the US market. Plus, the opportunities in emerging markets are also thriving,” he added.

Mobius articulated a cautiously optimistic outlook for global and Indian economic trends, driven by both cyclical and structural factors. Tapering off Russia-Ukraine conflict and reduced Middle East turmoil, are expected to bolster global growth, he noted.(Agency)