Mumbai, Nov 7, 2024

The fate of around 1.48 lakh retail shareholders who hold around 20 per cent stake in the beleaguered Jet Airways remains uncertain after the Supreme Court ordered the liquidation of Naresh Goyal-led grounded airline.

At the current market capitalisation of Jet Airways at Rs 386.69 crore, retail shareholding in the airline is around Rs 74.6 crore.

Retail shareholders held around 20 per cent stake in Jet Airways (as of September 30). Other major shareholders include Etihad Airways (24 per cent) and the erstwhile promoters (25 per cent).

The stock of Jet Airways, locked in a 5 per cent lower circuit following the order, ended at Rs 34.04 apiece on Thursday. The share hit a high of Rs 63.15 in March but has lost more than 46 per cent since then.

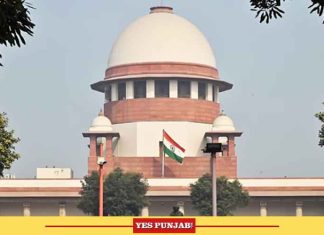

A Bench, headed by CJI DY Chandrachud, allowed the lenders’ plea against the transfer of ownership of the grounded airline to Jalan Kalrock Consortium (JKC). The Bench invoked its extraordinary powers under Article 142 of the Constitution “for doing complete justice” between the parties and ordered the appointment of a liquidator forthwith.

Further, it ordered the forfeiture of Rs 200 crore infused by the JKC and directed lenders to invoke the Rs 150 crore Performance Bank Guarantee (PBG).

In the plea filed before the apex court, the Committee of Creditors (CoC), led by the State Bank of India, has said that the proposed revival plan was not in the best interest of lenders and questioned the National Company Law Appellate Tribunal (NCLAT) order upholding the resolution plan.

Due to severe financial distress, Jet Airways, once one of India’s largest and most popular airlines, entered the corporate insolvency resolution process under the Insolvency and Bankruptcy Code (IBC) in June 2019.(Agency)