Mumbai, Aug 11 2024-

The markets regulator SEBI on Sunday advised investors to remain calm and exercise due diligence before reacting to inaccurate reports like Hindenburg.

In a statement, SEBI said that investors should assume that Hindenburg Research may have short positions in the securities covered in the report.

Notably, the allegations made by Hindenburg Research have been duly investigated by SEBI.

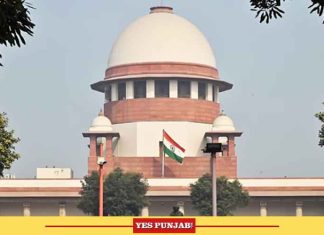

“The Supreme Court, in its order of January 3, 2024, noted that SEBI had completed 22 out of 24 investigations. Subsequently, one more investigation was completed in March 2024, and one remaining investigation is close to completion,” said the markets regulator.

During the ongoing investigation in this matter, more than 100 summons, around 1,100 letters and emails have been issued to seek information, informed SEBI.

“Further, more than 100 communications have been made seeking assistance from domestic/foreign regulators and external agencies. Also more than 300 documents containing around 12,000 pages have been examined,” the SEBI informed.

The report also seeks to question SEBI’s action in issuing a show-cause notice to Hindenburg Research on June 27, 2024.

The show-cause notice in question, alleging violations of securities laws by Hindenburg Research, has been issued by following the due process of the law, said SEBI.

“It is noted that Hindenburg Research has itself made the show-cause notice issued to it available on its website. The show-cause notice contains the reasons for its issuance. The proceedings in this matter are ongoing and the same is being dealt with in accordance with the established procedure and in compliance with the principles of natural justice,” the markets regulator stressed.

The Hindenburg report has also claimed that the implementation of the SEBI (REIT) Regulations 2014 as well as changes in such regulations had resulted in significant benefit to a large multinational financial conglomerate.

“Claims that such regulations, changes to regulations or circulars issued related to REITs were to favour one large multinational financial conglomerate, are “inappropriate”, SEBI said.

SEBI has adequate internal mechanisms for addressing issues relating to conflict of interest, which include a disclosure framework and provision for recusal.

Over the years, it has built a “robust regulatory framework that not only aligns with best global practices but also ensures protection of investors.”

“SEBI remains committed to ensuring the integrity of India’s Capital markets and its orderly growth and development,” it added. (Agency)