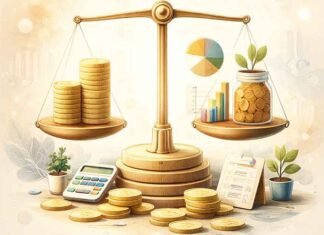

Your CIBIL score has a significant impact on your financial life. Whether you are taking an instant personal loan online, a credit card, or even a home loan, lenders verify this score to understand how good you are at paying back.

A good CIBIL score (750 and above) makes it easy. You get quicker approvals, good interest rates, and larger loan amounts. But if your score is poor, taking money can be difficult.

Top 10 Smart Ways to Improve Your CIBIL Score Quickly

Pay Your EMIs and Credit Card Bills on Time

Nothing drops a CIBIL score faster than missed payments. Whether it’s a loan EMI or a credit card bill, even one delay can bring your score down. Lenders see timely payments as a sign of reliability.

Set up auto-debit for loan EMIs and credit card bills.

Use reminders to avoid missing due dates.

If full payment isn’t possible, at least pay the minimum due amount on your credit card.

Don’t Apply for Too Many Loans at Once

Every time you apply for a loan or credit card, the lender does a hard inquiry on your credit report. Too many inquiries in a short period lower your CIBIL score and make you look desperate for credit.

Compare lenders before applying, not after.

If your loan application is rejected, wait a few months before applying again.

Prefer pre-approved offers, as these don’t affect your score.

Maintain a Healthy Credit Mix

A mix of secured loans (home loan, car loan) and unsecured loans (personal loans, credit cards) helps build a strong credit profile. Lenders prefer borrowers who can manage different types of credit responsibly. If you only use credit cards, consider taking a small secured loan and repaying it on time to improve your credit history.

Keep Your Old Credit Cards Open

Many people close their oldest credit card once they clear the dues. But this can actually hurt your CIBIL score. Older credit accounts show long-term credit history, which is a big factor in your score.

Instead of closing your oldest card, keep it active with small purchases and repay them fully. This helps maintain a strong credit history.

Clear Your Existing Debts

If you have multiple loans or unpaid credit card balances, and repaying them strategically to see how to improve cibil score quickly. Some of the best strategies include, but are not limited to:

Avalanche method – Pay off loans with the highest interest rate first.

Snowball method – Clear the smallest debts first to close multiple accounts quickly.

Debt consolidation – Take a lower-interest personal loan to pay off multiple debts.

Check Your Credit Report for Errors

Mistakes in your CIBIL report can lower your score unfairly. If there’s an error, like a wrongly reported missed payment, you need to get it fixed immediately.

Get a free credit report from CIBIL once a year.

Look for incorrect loan accounts, wrong personal details, or outdated payment history.

Raise a dispute with CIBIL to correct any mistakes.

Start Building Credit If You Have No Credit History

If you’ve never taken a loan or used a credit card, you won’t have a CIBIL score. This can make it harder to get approved for loans in the future.

Get a secured credit card against a fixed deposit.

Take a small consumer loan and repay it on time.

Apply for a co-signed credit card with a family member.

A good repayment record will help you build a strong CIBIL score over time.

Use Instant Personal Loans Responsibly

An instant personal loan online can be a great way to get quick funds, but mismanaging it can damage your credit score. If you keep taking multiple personal loans and struggle with repayments, it signals financial trouble.

Borrow only what you can comfortably repay.

Choose longer tenures if you need lower EMIs.

Repay existing loans before applying for a new one.

When used wisely, a personal loan can actually help improve your credit score by building a strong repayment history.

Conclusion

Improving your CIBIL score isn’t complicated, but it requires consistent financial discipline. Paying your EMIs on time, keeping your credit usage low, and avoiding unnecessary loan applications can help you see quick improvements in your score.

If you’re planning to apply for an instant personal loan online, increasing your CIBIL score first will help you get better interest rates and faster approvals.

Follow these 10 steps, and you’ll be on your way to a stronger credit profile in no time.