New Delhi, April 28, 2019-

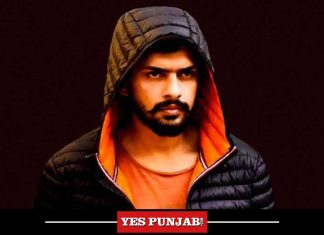

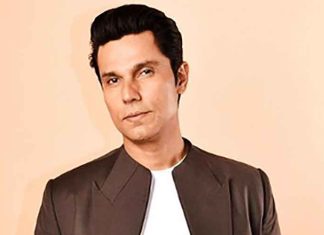

Xiaomi and Samsung are the arch rivals in the India smartphone market but it doesn’t mean they do not have anything to learn from each other. Ask Xiaomi’s India Managing Director Manu Kumar Jain and you have the answer.

In his first-ever humble admission, Jain says the company is learning from other brands, including the offline giant Samsung, in its push for retail sales in the country.

Xiaomi, largely known as an online brand, started its offline journey in India just two years ago and claims that it has already captured 20 per cent share of the offline smartphone business in the country.

“It was a tough beginning. We were hardly able to sell any smartphone offline in the first six months,” Jain told a select group of journalists here.

“We are learning from other other brands such as Samsung and Vivo in expanding our offline presence in the country,” Jain added.

According to market research firm Counterpoint Research, aggressive offline expansion helped Xiaomi retain its top position in the India smartphone market in the first quarter of 2019 with a 29 per cent share, though its shipments declined by two per cent year-over-year.

Samsung, which recently launched the online-only “M” smartphone series, followed the Chinese smartphone maker with 23 per cent share, a drop of three per cent from 26 per cent share in the same quarter last year.

Xiaomi has now set a target of opening 10,000 retail stores in the country and aims to have 50 per cent of its smartphone sales in India from offline channels by the end of this year.

Jain explained that the company’s scope of growth in India’s online market share became limited after it captured over 50 per cent share in that market.

This is one of the main reasons why the company is pushing its offline expansion aggressively. But offline expansion also brings with it additional cost and Jain had no hesitation in admitting that.

Responding to a question on whether the aggressive offline push could hurt its profitability, especially because Xiaomi has a policy of not keeping more than five per cent profit margin from its hardware, Jain said: “It is true that the cost of doing business in offliine is higher than online.

“I can say confidently that our cost of running offline business would be the lowest among all the brands. Other brands generally tend to have three-four layers of distributors – national, state, city and sometimes, even micros distributors – before the product reaches the retailers and consumers. But we have only one level of distribution,” he explained.

“The biggest hit on profitability does not come from offline. It comes from dollar fluctuations. If dollar goes up, our cost goes up. This is because even though we are manufacturing components in India, most of the components are still purchased in dollar.”

Even though its operational expenses in selling smartphones goes up, that should not be the company’s biggest worry in the future as its aim is to earn most of the mullah from its Internet services.

“We want to make money from Internet service like Mi Video (a pre-installed video app which provides integrated video streaming across platforms),” Jain said. (Agency)