New Delhi, Jan 14, 2020-

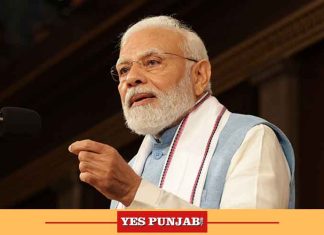

Former Congress chief Rahul Gandhi here on Tuesday termed the rising inflation and unemployment as signs of the “economic emergency” and taunted the Prime Minister Narendra Modi of doing ‘tukde tukde’ (breaking into pieces) of the budget of the common people.

“High inflation, unemployment and falling GDP have created a state of ‘economic emergency’. Rising vegetables, pulses, edible oil, LPG prices have snatched the food from the poor. Modiji has broken the domestic budget of the countrymen into pieces,” Rahul Gandhi, also the MP from Wayanad in Kerala, said in a tweet in HIndi.

Rahul Gandhi used the ‘tukde-tukde’ jibe against the Prime Minister as the BJP has been accusing the Congress of supporting the ‘tukde-tukde’ gang. It’s often referred to the Jawaharlal Nehru University Students Union (JNUSU) after they raised slogans on the campus.

His remarks have come a day the official data showed on Monday that massive rise in food prices had lifted the December retail inflation to 65-month high of 7.35 per cent from 5.54 per cent in November.

Earlier in the day, party General Secretary Priyanka Gandhi Vadra also criticised the Modi government, saying the BJP had “kicked” on the stomach after picking the poor’s pockets.

“Prices of vegetables and food items are getting out of the reach of common people. What will the poor eat when vegetables, edible oil, pulses and wheat flour become expensive? Due to recession people are not getting work,” she tweeted.

As per the National Statistical Office (NSO) data, the consumer price index (CPI) for December was higher than the year-ago month when the retail inflation stood at 2.11 per cent.

Similarly, the consumer food price index (CFPI) inflated to 14.12 per cent during the month under review from an expansion of 10.01 per cent in November 2019 and (-)2.65 per cent rise reported for the corresponding period of last year.

In addition, the data assumes significance as the Reserve Bank of India in its last monetary policy review maintained the key lending rates on account of rising retail inflation. (Agency)