New Delhi, May 6, 2021 –

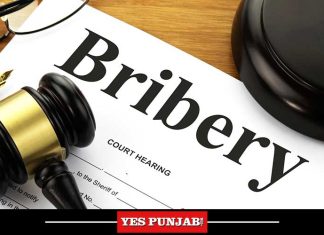

Non-residents undertaking transactions with Indian parties will trigger taxability under the domestic law in India even if they do not have physical presence in the country and operate digitised businesses.

The Central Board of Direct Taxes has notified new rules for operation of business by non-residents under which any transaction over Rs 2 crore (apex $27,100) in respect of any goods, services or property carried out by them with any person in India including provision of download of data or software in India, will attract tax in India.

The provisions of Significant Economic Presence (SEP) that becomes the base for taxability of non-residents in India will also apply if the number of users with whom systematic and continuous business activities are solicited (or who are engaged in interactions) exceeds 3 lakhs.

The provisions of Significant Economic Presence (SEP) were introduced in the legislation in 2018 with an intent to tax non-residents operating digitised businesses which function without a physical presence. It meant that SEP of a non-resident in India shall constitute a ‘business connection’ in India.

These provisions were further amended vide Finance Act, 2020 which defined SEP as transaction in respect of any goods, services or property carried out by a non-resident with any person in India including provision of download of data or software in India, if the aggregate of payments arising from such transaction or transactions during the year exceeds a threshold or systematic and continuous soliciting of business activities or engaging in interaction with a defined number of users in India.

The new provisions are applicable with effect from Financial Year 2021-22. It had become fully functional now with CBDT notifying the thresholds for triggering SEP and consequently tax liability in India.

According to PwC, the Central government has now made it clear that economic presence in India by non-residents is not limited only to the physical presence in India but also includes a virtual establishment. But non-residents could offset the taxability under these provisions by exploring taking relief under Double Taxation Avoidance Agreements. (Agency)

Subscribe to YesPunjab Telegram Channel & receive important news updates