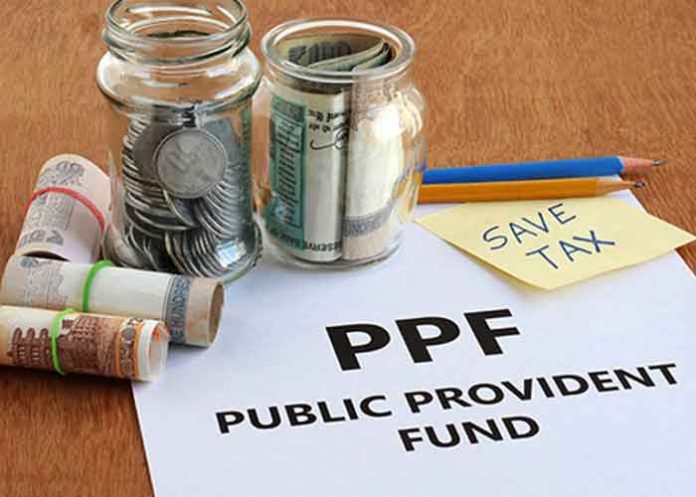

Wondering about the process of calculating interest on PPF balance? PPF (Public Provident Fund) is one of the most popular choices for investors which offer great options for saving taxes under Section 80C of the Income Tax Act.

The interest earned is also non-taxable along with the overall maturity amount. The rate of interest that applies for PPF investments is announced by the Government on a quarterly basis post review. For the quarter concluding on the 31st of March, 2020, the rate of interest offered by the Government was at 7.9% per annum (yearly compounding).

What influences your PPF returns is that interest calculation is done on a monthly basis although the interest is credited into the account by the end of a financial year on the 31st of March. Interest is payable for that particular month in case the deposit has been made prior to the 5th of the specific month. A minimum investment of Rs. 500 can be made while a maximum amount of Rs. 1.5 lakh can be invested in a particular financial year.

Calculation of PPF interest for working out the balance

Let us assume that you make an investment of Rs. 10,000 every month in PPF and also assume that the rate of interest is 7.1% and remains the same throughout the particular financial year in question. Now, the interest will be calculated on the monthly basis. This means that you will be earning Rs. 29,26,633 as interest while depositing Rs. 24,00,000.

This will give you a total maturity amount of Rs. 53,26,633 for a duration of 20 years. Interest can be calculated on the lump sum basis as well. Keeping the rate of interest the same, suppose you make a yearly deposit of Rs. 1, 50, 000 at the same rate of interest (7.1%), then you will deposit Rs. 30,00,000 for a 20-year tenure and earn higher interest of Rs. 36,58,287.

You should remember that the maximum PPF deposit in a single year should be Rs. 1,50,000. This will get you the maximum tax deduction allowed under Section 80C of the Income Tax Act as well. Do bear in mind that this Section covers other investments made in life insurance, home insurance principal repayments and so on.

Monthly Interest Calculation on PPF

The interest on PPF is paid out based on the lowest balance in your PPF account from the 5th to the last day of each month. Hence, it is always advisable to make your PPF contribution before the 5th of every month.

For example, if you have zero account balance until the 10th of a particular month, you will not get any interest in the given month. Your interest will start running the following month. But if you have made the contribution before the specified date, the interest earned will be more.

PPF interest rate patterns and other factors

The rate of interest is reviewed by the Government on a quarterly basis as mentioned earlier. The rates of interest for FY 2019-20 stood at 7.1% for the quarter between April-June and 7.1% for the quarter between July-September. For the quarter between October and December, this rate stayed the same while it was also at 7.1% for the quarter that ended in March 2020.

For FY 2020-21, the rate remains to be unchanged; This makes it the consecutive third quarter in a row in which the government did not change the interest rate.

To maximize your advantages arising from PPF investments, you should ideally make your contribution each month before the 5th in order to maximize your return. The lump-sum contribution facility should be availed, if you are interested in this mode, prior to the 5th of April every year. This is because deposits that are made before the 5th of a particular month, will get you full interest for that particular month in question.

Year wise PPF Interest Rates

| Period | Interest Rate |

| October to December 2020 | 7.10% |

| July to September 2020 | 7.10% |

| April to June 2020 | 7.10% |

| January to March 2020 | 7.90% |

| October to December 2019 | 7.90% |

| July to September 2019 | 7.90% |

| April to June 2019 | 8.00% |

| January to March 2019 | 8.00% |

| October to December 2018 | 8.00% |

| July to September 2018 | 7.60% |

On a closing note

For working out your PPF balance, remember that the PPF interest amount which is due for your account is calculated each month on the lowest balance at the credit of the account from the closing of the 5th day of the particular month and the end of the particular month.

Interest calculations will be done on a monthly basis for your PPF account although it will be credited at the conclusion of each financial year. Based on the PPF Scheme of the year, interest will be credited at the conclusion of the financial year, irrespective of the change in the account office owing to account transfer during any specific year.